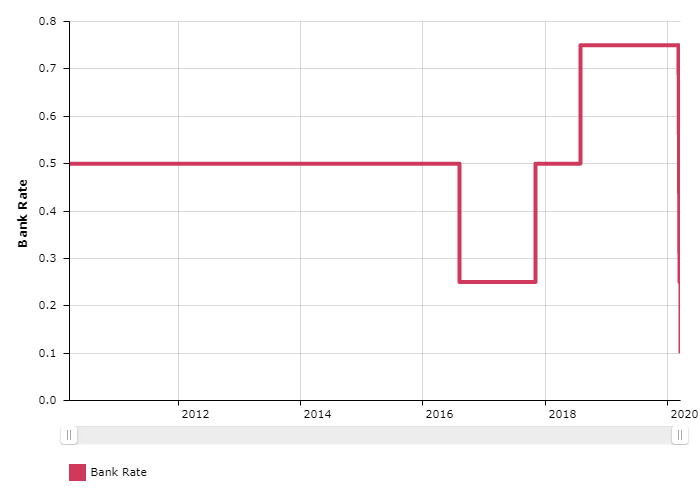

The Bank of England has risen interest rates for a 13th consecutive time as it continues to tackle rising prices.

Experts were predicting a slight fall in inflation figures in May, but official data on Wednesday showed inflation was still stuck at 8.7% in May, due to increased prices for second-hand cars, flights and supermarket food prices.

The Base Rate of 5.00% is the highest the UK has seen since 2008.

Just one month ago experts were predicting we were nearing the end of rate rises, but the rhetoric has changed as base rate could now reach 6.00% – a figure not seen since the 1990’s.

Thameside Mortgages Managing Director, Andrew Sheen pointed out “a fundamental role of the Bank of England is to control inflation. It’s painfully obvious increasing rates has been an ineffective tool against inflation.

“Rather than stubbornly sticking to the same methods, they should take a moment to pause and consider a different approach before causing significant harm to the economy and people’s livelihoods.”

Read more