Becoming a homeowner is a dream for many renters, but the hefty deposit requirements can often make it seem impossible. With house prices and the cost of living on the rise, saving five-figure sums for a deposit can be a daunting prospect. But now, there is a solution.

Read moreInterest Rates increased to 4.25%

The Bank of England recently announced that it had increased interest rates to 4.25%.

In this article, we highlight the significance of reviewing your mortgage as early as possible and delve into the consequences of increasing interest rates.

Read moreBank of England reduce rates to lowest in history

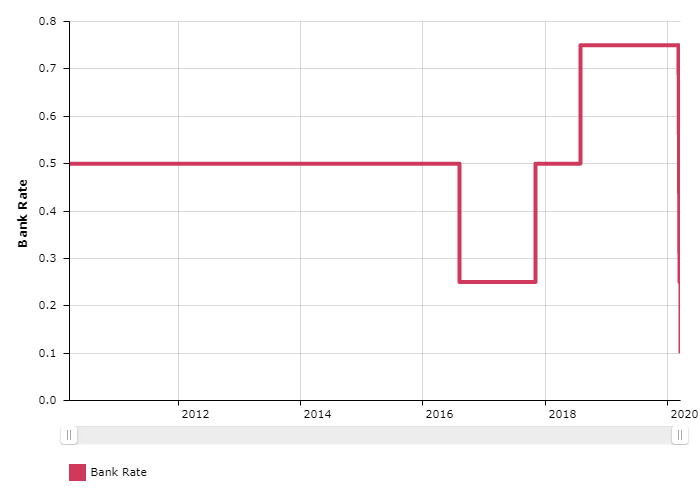

The Bank of England has once again cut interest rates in an emergency move to shore up the UK economy in the wake of the Covid-19 pandemic.

This is the lowest interest rate in the history of the Bank of England.

The Bank is also looking to restart its Quantitative Easing measures, by increasing its holdings of bonds by£200bn.

It was just last week that the Bank of England moved to reduce rates to 0.25%

Get In Touch – Live Chat

We have already been speaking with our own customers about this, but we have also spoken with new clients who would like to revisit their finances and compare their current mortgage rates to the already extremely low rates on offer from the 90+ mortgage lenders we have access to.

We have a Live Chat facility on our website that can help answer your questions.

Post from Thameside Mortgages

Your home may be repossessed if you do not keep up repayments on your mortgage. There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances, a typical fee will be £399

Bank of England Slash Rates to 0.25%

On Wednesday 11th March 2020, the UK Bank of England announced that they have reduced interest rates by 0.50%, to 0.25% as a response to the wake of the Coronavirus.

We have already received an unprecedented amount of enquiries from new and existing clients asking what this may mean for them.